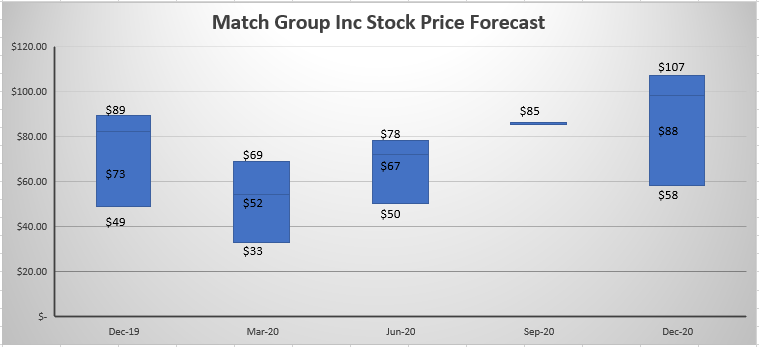

Our valuation model for Match Group Inc (NASDAQ: MTCH) estimates a target price of $107 by Dec 31st 2020.

A detailed report can be downloaded here.

Business Summary

Match Group, Inc (Nasdaq: MTCH), through its portfolio companies, is a leading provider of dating products available in over 40 languages to our users all over the world. Our portfolio of brands includes Tinder®, Match®, PlentyOfFish®, Meetic®, OkCupid®, OurTime®, Pairs™, and Hinge®, as well as a number of other brands, each designed to increase our users’ likelihood of finding a meaningful connection. Through our portfolio companies and their trusted brands, we provide tailored products to meet the varying preferences of our users. Match Group has one operating segment, Dating, which is managed as a portfolio of dating brands.

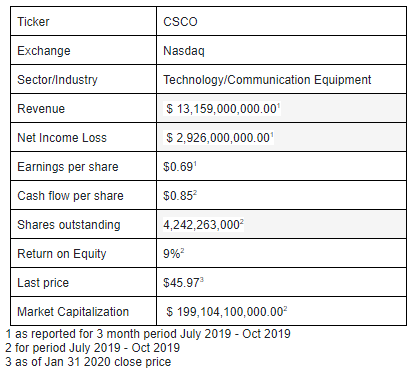

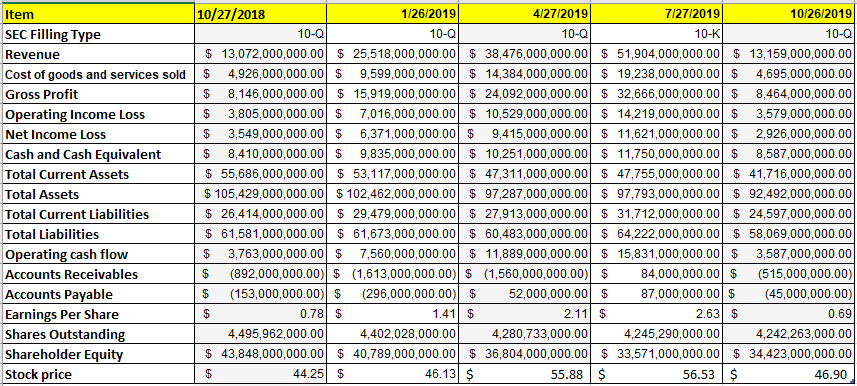

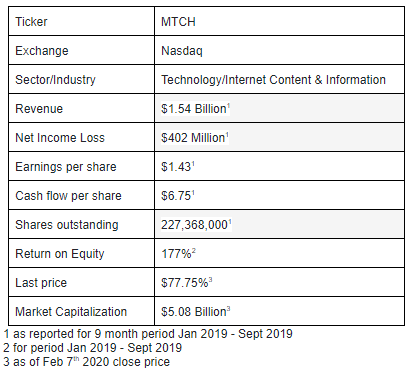

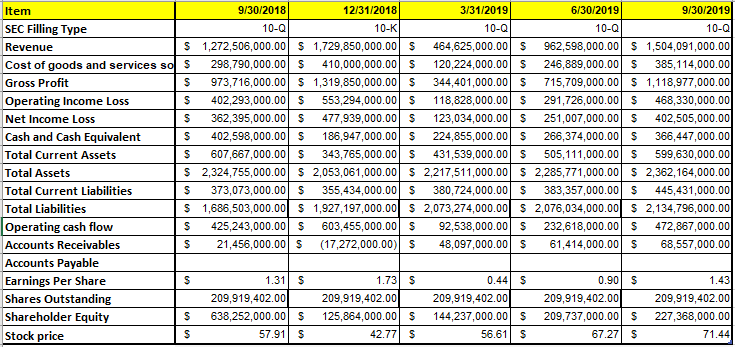

Company Fundamentals

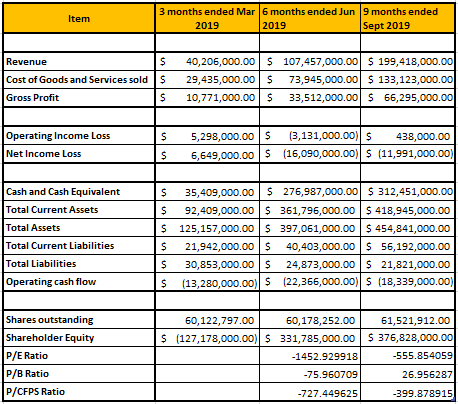

Match Group Inc reported an earnings of $1.504B in their Q3 FY 2019 earnings report. The below table provides a summary of their previous 5 SEC fillings.

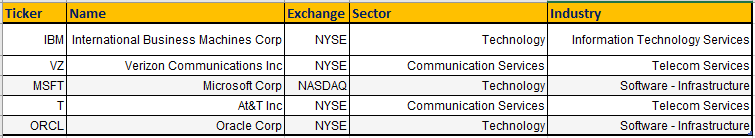

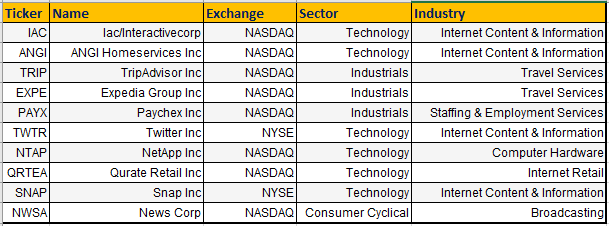

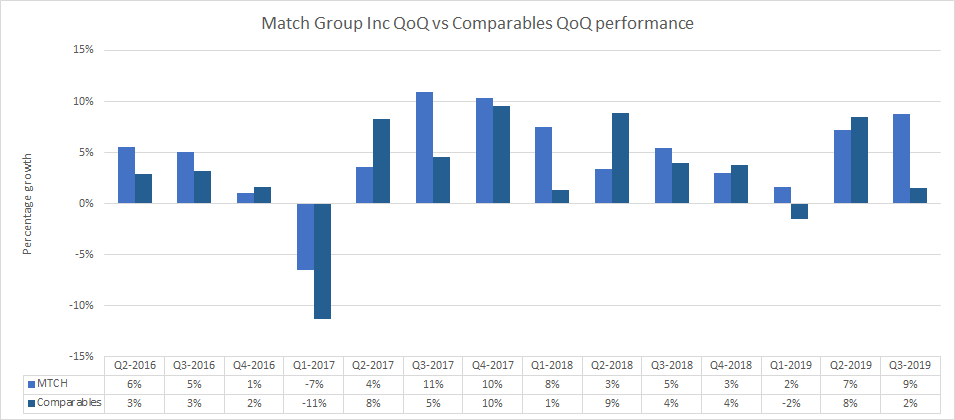

Comparative Analysis

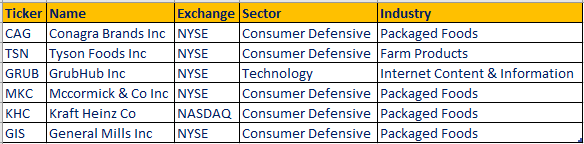

The comparables companies we used for analysis are listed below

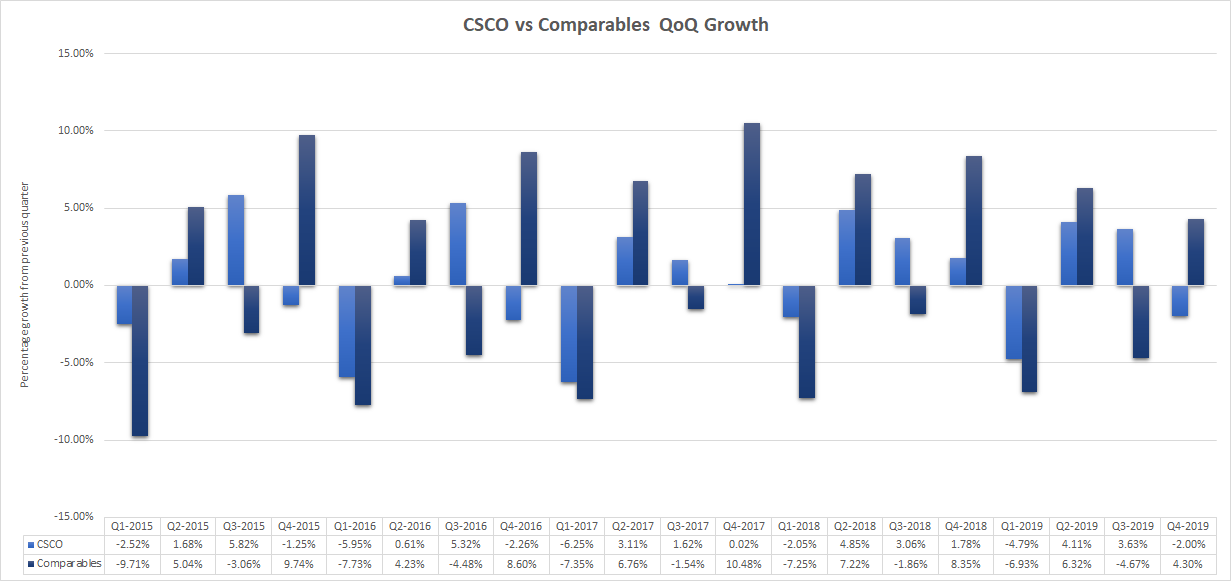

As compared to them Match Group Inc QoQ performance is

Disclaimer

The information provided in the document is for general informational and educational purposes only and is not intended to provide specific investment advice.

The data and content presented herein is only as reliable as the sources from which it is obtained, and the accuracy and completeness of the information presented cannot be guaranteed. You agree to indemnify Daizika LLC, all its employees, officers, directors, managers and author(s) of this blog and hold it harmless from any actions, claims, proceedings, or liabilities arising from your use of the Content.

You agree that Daizika LLC and the Author is not liable for any success or failure of your business that is directly or indirectly related to the use of our information.

A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned in this report.

All statements and expressions are the sole opinion of the author and are subject to change at any time without notice.