Our valuation model for Beyond Meat (NASDAQ: BYND) estimates a target price of $134 by Dec 31st 2020 with a “Hold” rating on the stock.

A detailed report can be downloaded here.

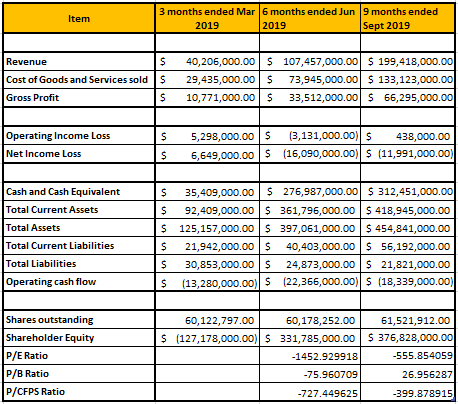

Company Fundamentals

Beyond Meat Inc. Revenue grew by 46% in Q3 of 2019 to $91.96Million, the expenses grew at almost the same rate, the net income loss of $4 Million. The company was able to reduce the long-term liabilities by 12% to $21.82 Million in the same time period.

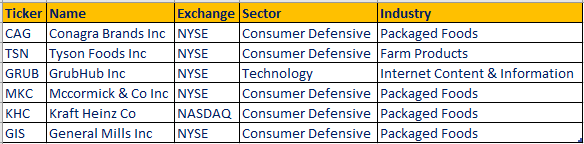

Comparative Analysis

The comparables companies we used for analysis are listed below

- The average 2019 Q4 growth is ~14% amongst the comparables

- Beyond Meat provided a full year 2019 revenue guidance in the range of 265Million - 275 Million in their 2019 Q3 earnings call

Business Summary

Beyond Meat, Inc., a Delaware corporation (the “Company”), is one of the fastest growing food companies in the United States, offering a portfolio of revolutionary plant-based meats. The Company builds meat directly from plants, an innovation that enables consumers to experience the taste, texture and other sensory attributes of popular animal-based meat products while enjoying the nutritional and environmental benefits of eating the Company’s plant-based meat products. The Company’s brand commitment, “Eat What You Love,” represents a strong belief that by eating the Company’s plant-based meats, consumers can enjoy more, not less, of their favorite meals, and by doing so, help address concerns related to human health, climate change, resource conservation and animal welfare.

The Company’s primary production facilities are located in Columbia, Missouri, and research and development and administrative offices are located in El Segundo, California. In addition to its own production facilities, the Company uses co-manufacturers in various locations in the United States to manufacture its products. In May 2019, the Company partnered with one of its distributors to co-manufacture the Company’s products at a new manufacturing facility being constructed by this distributor in the Netherlands for estimated completion in 2020.

The Company sells to a variety of customers in the retail and foodservice channels throughout the United States and internationally through brokers and distributors. All of the Company’s long-lived assets are located in the United States.

Disclaimer

The information provided in the document is for general informational and educational purposes only and is not intended to provide specific investment advice.

The data and content presented herein is only as reliable as the sources from which it is obtained, and the accuracy and completeness of the information presented cannot be guaranteed. You agree to indemnify Daizika LLC, all its employees, officers, directors, managers and author(s) of this blog and hold it harmless from any actions, claims, proceedings, or liabilities arising from your use of the Content.

You agree that Daizika LLC and the Author is not liable for any success or failure of your business that is directly or indirectly related to the use of our information.

A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned in this report.

All statements and expressions are the sole opinion of the author and are subject to change at any time without notice.